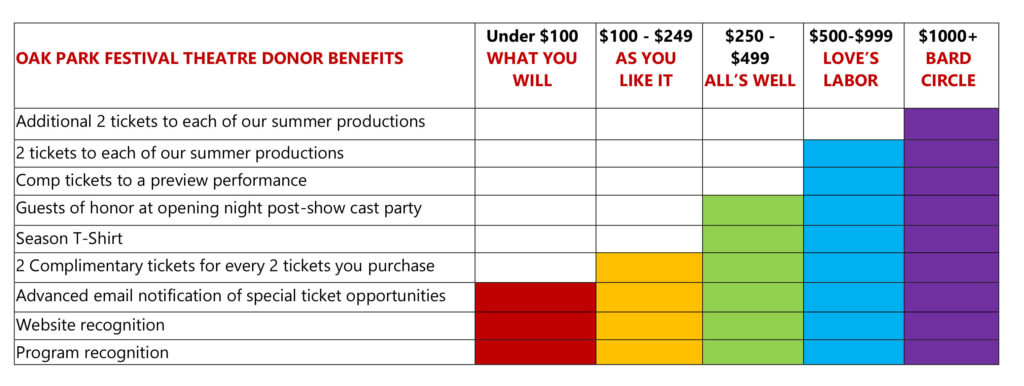

Benefits of Giving

ANNUAL DONOR BENEFITS

Our donor program is our way or recognizing the critical role our donors play and their dedication to maintaining Oak Park Festival Theater’s long tradition of commitment to theatrical excellence.

Your charitable gift to Oak Park Festival Theatre allows us to produce timeless and relevant works of art while deepening our impact in the community… and it can also reduce your annual income tax!

Cash Gifts are Tax-Deductible

As a qualified charitable organization, cash donations to OPFT are tax deductible. There are no limits on charitable contributions for most taxpayers and most can deduct cash contributions in full up to 50% of their adjusted gross income.

Gifts are Deductible in the Year they are Made

Gifts to Oak Park Festival Theatre are considered paid when you put the check in the mail, or when it is charged to your credit card (not when you pay the credit card company). Make sure that your donation is made by December 31 so that it counts toward the year you plan to claim a deduction.

For more information…

Talk to Your Advisor

When making a gift to the OPFT, you can have your CPA, attorney, or other advisor help you better understand the impact of your gift on your income tax return and estate.

Contact us!

If you have questions or would like to learn about the benefits of charitable giving, please contact Jhenai Mootz, our Managing Director, at jhenai@oakparkfestival.com

CONTRIBUTE TO AN EXCITING TRADITION!

Oak Park Festival Theatre is a 501(c)3 nonprofit, charitable organization. Donations are tax deductible to the full extent of the law.[give_form id=”4488″]